Indicators on Offshore Trust Services You Should Know

Table of ContentsThe Of Offshore Trust ServicesThe Greatest Guide To Offshore Trust ServicesThe smart Trick of Offshore Trust Services That Nobody is DiscussingOffshore Trust Services Fundamentals ExplainedAbout Offshore Trust ServicesAbout Offshore Trust Services

The next step includes picking an individual or a foreign count on firm that might function as the overseas trustee. Comparable to a residential possession protection trust fund, the trust deed will certainly detail how the international trustee ought to make use of the count on's assets. It's ideal to start this process with an property protection attorney that can assist you arrange out the lawful information. The Internal Profits Service has raised surveillance of overseas counts on in current years, and conventional tax obligation laws still apply.

How Offshore Trust Services can Save You Time, Stress, and Money.

Costly trustee fees could trigger your overseas asset security worth to decrease with time, making practical fees a need for a quality trust fund company. In the web age, it's easy to find customer testimonials on any given business. Evaluations alone might not persuade your choice, yet reading about former clients' experiences could assist you lay out inquiries to ask prospective trustees as well as contrast firms.

Numerous legal entities provide their consumers asset protection services, yet the quality of a potential trustee will depend upon their experience with various kinds of trusts. As an example, someone who intends to develop a little family members trust will have different lawful demands than a person looking for financial investment possibilities (offshore trust services). It would certainly be best if you located a trustee that can satisfy the expectations for count on management according to your objectives.

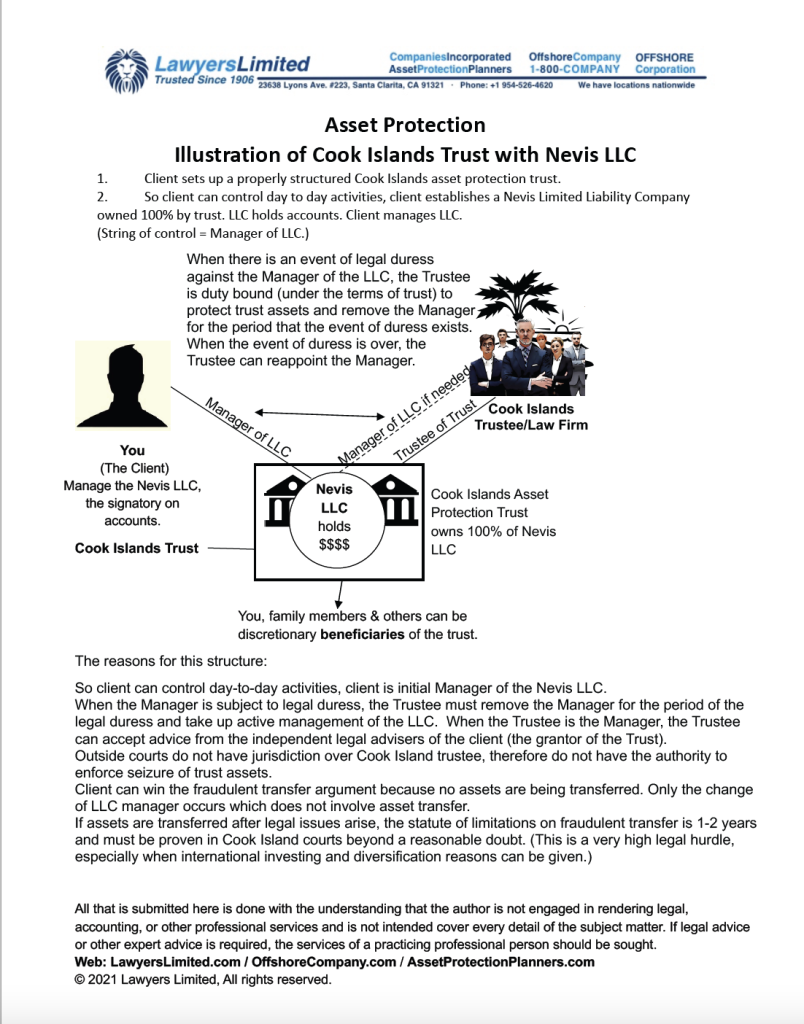

An is a lawful device that allows a private to safely safeguard their assets from financial institutions. An offshore depend on jobs by moving possession of the assets to an international trustee outside the territory of U.S. courts. While not needed, usually the offshore trust fund only holds properties located outside of the USA.

Not known Details About Offshore Trust Services

Chef Islands counts on can be developed to protect all count on assets from United state civil creditors. The trustmaker appoints a trustee that is either a private resident of a foreign nation or a trust fund firm with no U.S

The trust needs to specify that the area of the trust fund (called the situs) controls depend on stipulations.

Offshore Trust Services - Questions

Eliminates your possessions from oversight of state courts. Permits you to disperse your assets properly upon your death. Offshore counts on are a component browse around these guys of offshore possession protection preparation. Offshore property defense is an asset security device that involves forming a trust fund or company entity in a desirable legal territory outside of the United States.

realty for an offshore count on or an offshore LLC, an U.S. court will still have jurisdiction over the debtor's equity and the home title since the home continues to be within the U.S. court's geographical jurisdiction. Offshore preparation might secure U.S. property if the residential property is encumbered by a home mortgage to an overseas bank.

A Biased View of Offshore Trust Services

financial institutions. A prospective debtor can obtain funds from an overseas bank, hold the funds offshore in a CD, as well as safeguard the finance with a lien on the building. The CD passion would certainly cover most of the finance expenditure. Alternatively, the finance profits might be held at a united state financial institution that is immune from garnishment, albeit making lower rates of interest but with even more hassle-free accessibility to the cash.

A trust guard can be given the power to transform trustees, reapportion beneficial rate of interests, or direct the financial investment of count on assets. Advisors may be foreign or U.S. individuals that have browse around this site the authority to guide the investment of trust fund possessions. An offshore depend on shields a united state borrower's properties from united state civil judgments primarily since the depend on's assets and also its trustee are situated past the lawful reach of U.S.

U.S. judges have no authority to compel an overseas trustee to take any type of action with count on assets. Financial institutions do not have legal ways to levy upon or conflict with the management of find this an offshore count on's assets. To levy or garnish offshore count on possessions, a united state judgment creditor would certainly have to re-litigate the underlying U.S

The Offshore Trust Services Diaries

This is hard, pricey, and hardly ever done. A Cook Islands trust fund is an offshore count on that is produced under the laws of the Cook Islands making use of a Chef Islands trustee. The Cook Islands are composed of 15 islands located in the South Pacific (same time zone as Hawaii). Chef Islands depend on firms are qualified as well as managed by the Chef Islands government.

Chef Islands count on companies are respectable, skilled, and also completely qualified. The Cook Islands are well-regarded as the premier place to set up an offshore trust. As one of the initial countries with positive overseas trust laws, the Chef Islands have al long history of court choices promoting the security afforded by its counts on.